Albert Manzo - Unpacking Modern Money Solutions

Imagine, for a moment, a financial helper that truly understands what it means to keep your money matters in order, without all the usual fuss or steep costs. This kind of assistance, you see, has traditionally been something many folks just couldn't get their hands on, or it came with a price tag that felt too big for everyday budgets. It often left countless individuals feeling a bit lost when it came to making good choices with their earnings, which, you know, can be a real source of worry for anyone trying to manage their household finances.

This situation has, for quite some time, created a space where people might feel a little uneasy about their financial path, perhaps wondering if they are making the most sensible decisions for their future. It's a common challenge, really, when you think about how complicated money matters can seem at times, especially without someone to offer a bit of plain-spoken direction. So, the idea of having a tool that helps smooth out those rough edges, making things a touch clearer and more approachable, is something that could, in a way, bring a lot of peace of mind to many households.

It's about creating a setting where those nagging doubts about money choices start to fade away, where the path to feeling financially secure becomes less of a mystery and more of a straightforward walk. This kind of vision suggests a future where everyone, regardless of their current financial standing, has access to the sort of clear, helpful advice that lets them feel confident about their spending, saving, and investing habits. It's about building something that helps people avoid those little financial missteps that can, you know, sometimes lead to bigger headaches down the road, making money management less of a chore and more of a comforting routine.

- Jim Jordan

- If You Think Dan Bilzerian Is An Interesting Character Wait Till You Hear His Dads Life Story

- Diana Ross

- Aaron Hernandez

- Baker Mayfield

Table of Contents

- How Does a Financial Helper Work, Anyway?

- What Does "Taking Charge" of Your Money Truly Mean for Albert Manzo?

- Why Are So Many People Choosing This Approach?

- Are There Different Ways to Use This Kind of Service, Albert Manzo?

- Making Investing Simple for Everyone

- A Different Kind of Albert - What's That About?

- Getting Help When You Need It, Albert Manzo

- Thinking About Your Financial Future

How Does a Financial Helper Work, Anyway?

When we talk about a financial helper, especially one like Albert, it's pretty interesting how your money is handled behind the scenes. You see, the funds you put into something like Albert Cash aren't just sitting in one spot all by themselves. Instead, they are kept together in what's called a pooled account. This means your money is grouped with funds from many other people, but it's all managed with a very specific purpose. These pooled accounts are typically held at places like Sutton Bank or Stride Bank, which, you know, are actual banks. And here’s a really important bit: these banks are members of the FDIC. That stands for the Federal Deposit Insurance Corporation, and it basically means your money is protected up to a certain amount, giving you a bit of a safety net, which is pretty reassuring for anyone, even someone like Albert Manzo, thinking about where their cash is kept.

Now, it's worth noting that Albert itself isn't a bank in the traditional sense. It doesn't have physical branches you walk into, and it doesn't issue its own bank charters. What it does, actually, is provide banking services through these partner banks, Sutton Bank and Stride Bank, which are, as mentioned, members of the FDIC. This setup is quite common in the world of financial technology, where innovative services team up with established financial institutions to offer things like secure places for your money. So, while you interact with Albert, the underlying banking work, the really important stuff like holding your deposits, is handled by these regulated banks. It’s a bit like having a helpful guide for your money, with the actual heavy lifting of keeping it safe done by trusted partners, which, to be honest, makes a lot of sense for peace of mind.

This arrangement, in some respects, allows Albert to focus on what it does best: giving you tools and insights for managing your money, while the banks handle the secure storage of your funds. It means you get the convenience of a modern app with the security of traditional banking. For anyone considering where to put their money, knowing that it's looked after by FDIC-insured institutions, even if through a third-party service, can make a big difference in feeling secure. It really helps build trust, you know, especially when you're dealing with something as important as your hard-earned cash. So, it's a partnership that aims to give you both innovation and reliability, which is a pretty good combination for anyone looking for smart financial solutions.

What Does "Taking Charge" of Your Money Truly Mean for Albert Manzo?

When we talk about really "taking charge" of your money, it's about getting a firm grip on where your cash goes, where it comes from, and how it can grow. With a tool like Albert, this means you can, in a way, oversee your entire financial picture from one spot. Think about it: budgeting, which helps you see exactly what you spend and where you might save a bit; saving, putting money aside for those big goals or unexpected moments; spending, keeping an eye on your daily outflows so you don't overdo it; and even investing, helping your money potentially work for you over time. All these different parts of your financial life can be brought together in what is, quite simply, a very effective application, making it easier to keep everything aligned.

This approach to money management is designed to give you a sense of control that might have felt out of reach before. It's not just about tracking numbers; it's about making informed choices that line up with your personal goals. For instance, if you're trying to save up for something significant, the app can help you set those targets and see your progress, which is pretty motivating. Or, if you find yourself wondering where all your money went each month, it can clearly show you those spending patterns, allowing you to adjust if you need to. It’s about giving you the ability to make those small, consistent adjustments that, over time, can lead to some truly significant financial improvements, which is a pretty powerful thing for anyone, like Albert Manzo, who values having a clear view of their money.

The beauty of having all these functions in one place is that it simplifies what can often feel like a very fragmented process. Instead of jumping between different apps or spreadsheets for budgeting, saving, and investing, everything is right there, accessible and connected. This kind of consolidation means less time spent organizing and more time actually doing something productive with your money. It allows for a more holistic view of your financial health, helping you to see how each piece fits together. So, it’s about making financial management less of a chore and more of an intuitive process, allowing you to feel more confident about your financial decisions, which, honestly, is what many people are looking for in a money tool.

Why Are So Many People Choosing This Approach?

It’s really something to think about, isn't it, how many people have decided to use a service like Albert? We're talking about more than ten million individuals who have, in a way, opted to bring this tool into their daily financial lives. This kind of widespread adoption suggests that there’s a genuine need out there for simpler, more accessible ways to manage money. People are looking for solutions that fit into their busy schedules, that don’t require a finance degree to understand, and that genuinely help them feel more secure about their financial future. The sheer number of users points to a strong belief in what the service offers, indicating that it truly resonates with a lot of folks looking for practical help.

One of the big reasons for this popularity, you could say, is the promise of making financial decisions less of a headache. Albert, it seems, is working towards creating a situation where no one has to constantly worry about making the wrong financial choices. This is a pretty big ambition, considering how many people struggle with money-related anxiety. For a very long time, getting good financial advice has often been either completely out of reach or just too expensive for the average person. This leaves a huge number of people feeling, well, pretty much on their own when it comes to making smart money moves, and that can be a really isolating feeling, which is something that many, like Albert Manzo, would understand.

So, when a service comes along that aims to bridge that gap, offering guidance that feels both approachable and affordable, it’s naturally going to attract a lot of attention. It’s about democratizing access to financial well-being, making sure that sound advice and helpful tools aren't just for those with deep pockets. The idea is to give everyone the chance to feel more in control of their money, to build confidence in their financial planning, and to generally reduce the stress that often comes with managing personal finances. This mission, to be honest, is a powerful draw for millions, showing that there’s a real hunger for financial empowerment that’s both practical and easy to use.

Are There Different Ways to Use This Kind of Service, Albert Manzo?

When you consider trying out a service like Albert, you'll find that there are a few different options for how you can engage with it, which is pretty handy. The plans available typically range in cost, starting from about $11.99 each month and going up to around $29.99 a month. This range suggests that there might be different levels of features or support included, allowing people to pick something that fits their specific needs and their budget. It’s nice to have that flexibility, really, because everyone's financial situation and goals are a little bit different, and a one-size-fits-all approach doesn't always work for managing money, even for someone like Albert Manzo.

What's also quite appealing is the chance to try out a plan before you commit to paying for it. You typically get a period of thirty days to test things out, to see how it feels and if it genuinely helps you with your money matters, before any charges actually come through. This trial period is a really thoughtful way to let people experience the service without any immediate financial pressure. It gives you enough time to explore the features, get a feel for how the app works, and decide if it truly aligns with your financial habits and aspirations. This kind of "try before you buy" approach is, in a way, a sign of confidence in what they offer, letting the service speak for itself.

This flexibility in pricing and the opportunity for a trial period make it much easier for people to consider incorporating such a tool into their lives. It removes some of the initial hesitation that might come with signing up for a new financial service, allowing you to gauge its value firsthand. So, whether you're just starting to think about getting a better handle on your money, or you're looking for a more advanced set of tools, having these choices means you can, more or less, find an option that feels right for you. It's about making the decision to improve your financial habits a little less daunting and a lot more accessible, which is a big plus for many people.

Making Investing Simple for Everyone

One of the really compelling things about a service like Albert is how it tries to make investing something that anyone can do, no matter how much money they have to start with. You can, for instance, begin putting money into investments with as little as a single dollar. This really changes the game for many people who might have thought investing was only for those with a lot of spare cash or a deep understanding of the stock market. It brings down that initial barrier, making it much easier to just get started and begin learning how it all works, which is pretty empowering for folks who are new to this whole world of growing their money.

Once you’re ready to put that dollar to work, you have options. You can put your money into individual stocks, which are small pieces of a company

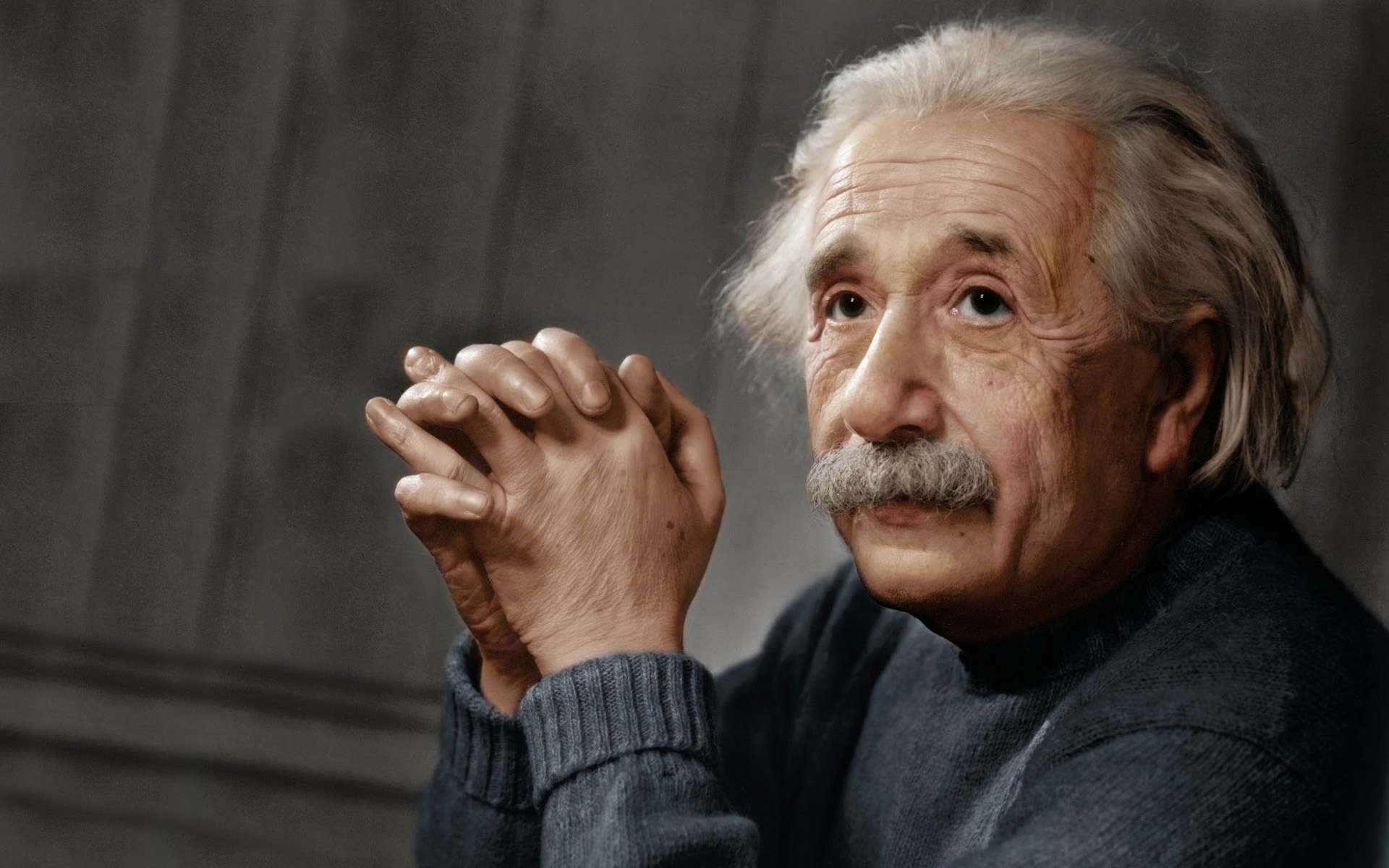

Albert Einstein Biography - Facts, Childhood, Family Life & Achievements

Albert Einstein Wallpapers Images Photos Pictures Backgrounds

Albert Einstein Wallpapers Images Photos Pictures Backgrounds